A paper by summarizes the Congressional Price range Workplace’s projections round US medical insurance protection between 2023-2033. They discover that low charges of uninsurance as a result of provisions enacted to fight COVID-19 is not going to be sustained as these provisions expire:

Momentary insurance policies enacted in response to the COVID-19 pandemic have elevated Medicaid and nongroup protection and decreased the variety of uninsured folks. The CBO estimates, on account of these will increase in general enrollment, which proceed into 2023, that the uninsurance fee will attain a file low of 8.3 p.c this yr. In 2033, after the short-term insurance policies have expired, enrollment within the protection classes most affected by the short-term insurance policies can be decrease, and the uninsurance fee will improve to 10.1 p.c

Word that this 10.1% fee–whereas larger than the present degree of uninsurance–remains to be under the 2019 uninsured degree of 12%.

Of the 76.6 million folks enrolled in Medicaid firstly of 2023, about 80% will stay on Medicaid, 12% will transition to non-public (employer or non-group protection) and eight% will grow to be uninsured.

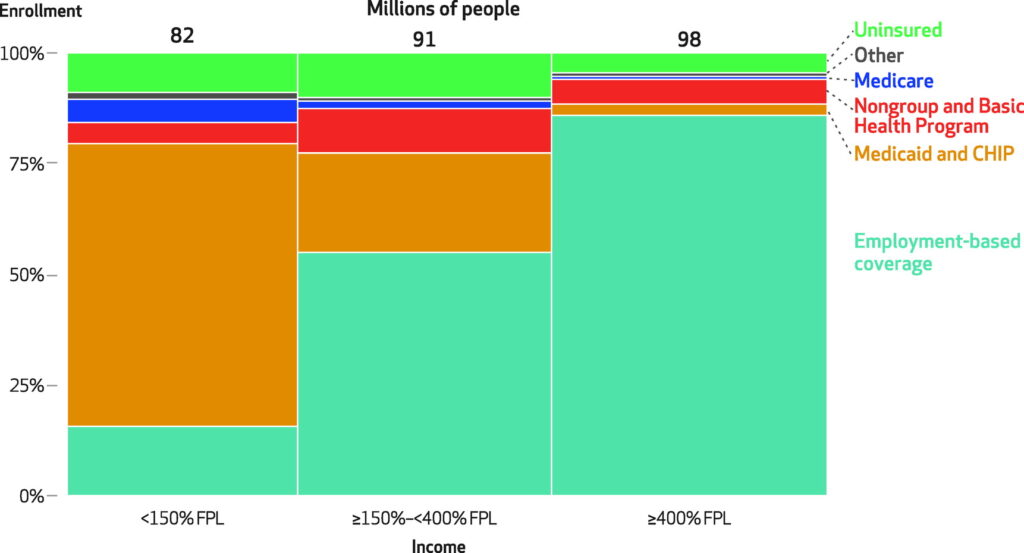

The article additionally supplies a extra detailed overview of medical insurance protection within the US. Whereas most all people aged 65 and above are coated by Medicare, the kind of insurance coverage people under 65 obtain varies dramatically relying on earnings. Decrease-income people usually tend to be on Medicaid; higher-income people usually tend to be on employer-sponsored insurance policy.

CBO additionally anticipate non-public medical insurance premiums to rise.

The CBO tasks that non-public well being insurers’ spending on per enrollee non-public medical insurance premiums, which mirror paid claims and administration, will develop by 6.5 p.c in 2023, a median of 5.9 p.c in the course of the 2024–25 interval, a median of 5.7 p.c in the course of the 2026–27 interval, and a median of 4.6 p.c in the course of the 2028–33 interval…The upper short-term progress charges partly mirror a bouncing again of medical spending from the suppressed ranges of utilization in the course of the preliminary months of the COVID-19 pandemic in 2020.

For extra particulars, you may learn the total article .